The Incoterms® 2010 rules are the International Chamber of Commerce (ICC) rules for the use of domestic and international trade terms. Historically, beginning from 1936, different editions and revisions of Incoterms have been carried out to update the rules in accordance with current international trade practices and technological changes (namely, Incoterms versions of 1953, 1967, 1976, 1980, 1990, and 2000 were in use before the current version – Incoterms® 2010.The latest 8th revision, – the Incoterms® 2010 rules, – take account of contemporary changes in transport practice, together with the spread of custom-free zones, increased use of electronic communication and security issues became more important due to the international terrorism development. Controlling source document is written in British English and is to be translated into 35+ languages over 2011. Incoterm Variants are generally used to further clarify the responsibilities of the exporter and of the importer in a given transaction.E.g., variant “EXW loaded” clarifies that the exporter agrees to load the goods on the vehicle provided by the importer, when the official Incoterm is silent on that specific point.

Incoterms Defined

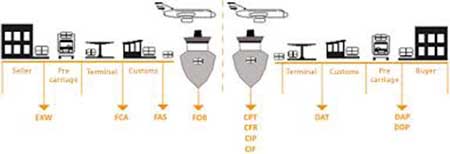

Incoterms are a collection of international rules (coded in three-letter acronyms: from EXW till DDP), with voluntary character for parts, that set the range of commercial clauses included in international sale and purchase contract; easy to understand for both contract parties as well as for a third party (e.g., case of arbitration).Incoterms are internationally accepted commercial terms defining the respective roles of the buyer and seller in the arrangement of transportation and other responsibilities and clarify when the transfer of ownership of the merchandise takes place; are used in conjunction with a sales agreement or other method of transacting the sale. In other words Incoterms are formalized convenient terms of trade regulated by the International Chamber of Commerce (ICC) which specify and split the responsibilities of the exporter and the responsibilities of the importer in an international transaction. Therefore, in accordance with the rule of Incoterms selected it should be clear:

- Which tasks will be performed by the seller/exporter

- Which tasks will be performed by the buyer/importer

- Which activities will be paid by the seller/exporter

- Which activities will be paid by the buyer/importer

- When the transfer of risk for the goods will take place

Some Notations in Incoterms® 2010

The last (2010) Incoterms revision becomes necessary to take account of the spread of custom-free zones, the increase in use of electronic communications, concerns about security following 9/11 and contemporary developments in global transport and trade for the last decade (since 2000).

- Formally, (A) cancelling four terms (DAF, DES, DEQ, DDU) and introducing two new terms (DAP, Delivered at Place; DAT, Delivered at Terminal); and splitting the rules of Incoterms® 2010 into two classes: (1) rules for any mode or modes of transport (EXW, FCA, CPT, CIP, DAT, DAP, DDP) and (2) rules for sea and inland waterway (FAS, FOB, CFR, CIF).

- Under both new rules, – DAT, DAP, – delivery occurs at a named destination: in DAT, at the buyer disposal unloaded from the arriving vehicle; in DAP, likewise at the buyer disposal, but ready for unloading. The named terminal in DAT may well be in a port (it looks as the former DEQ), but the arriving means of transportation under DAP may well be a ship and the named place of destination may well be a port (it looks as the former DES). Naturally, defining the place as the entry point on the frontier in DAP gives the terms of the former DAF. Concerning former DDU it is possible to say tha this term was not rather well popular and now is entirely taken over by the DDP.

- Beginning from 1936, rules of Incoterms have been useв as terms of international trade. However, the geopolitical situation in the world is drasically changed today. The European Union,- the highest level of economic and political integration, – as well as other trade blocs (customs unions) have made border formalities between different countries less significant. Therefore, the Incoterms® 2010 rules are announced now as they are available for application to both international and domestic sale contracts. Additional incentive to apply the Incoterms® 2010 rules not only to international sales contracts but to domestic ones is the common trend in the domestic trade of the United States to use these rules instead of the former Uniform Commercial Code shipment and delivery terms.

- For the first time, in the 1990 revision of Incoterms, the clauses dealing with the seller’s obligation to provide proof of delivery permitted a replacement of paper documentation by EDI-messages provided the parties had agreed to communicate electronically . Therefore, while previous versions of Incoterms rules have specified those documents that could be replaced by EDI messages, the Incoterms® 2010 rules (Articles A1/B1) directs that electronic means of communication has the same effect as paper communication, as long as the parties so agree or where customary. This formulation facilitates the evolution of new electronic procedures throughout the lifetime of the Incoterms® 2010 rules.

- The Incoterms® 2010 rules have placed information duties relating to insurance in articles A3/B3, which deal with contracts of carriage and insurance. This fact helps to focuse an attention of the seller/buyer on the insurance item in the frame of the contract of carriage and to clarify their resposibilities. Additionally, the text of the said articles has also been altered with a view to clarifying the parties obligations in this regard and took account of the last (2009) revision of the Institute Cargo Clauses

- Heightened concern (especially, after 9/11) about security in the movement of goods demands verification that the goods do not pose a threat to life or property for reasons other than their inherent nature. This is a reason why the Incoterms® 2010 rules have allocated obligations (Articles A2/B2 and A10/B10) between the buyer and seller to obtain or to render assistance in obtaining security-related clearances, such as chain-of-custody information, which using independent auditing, rigorously certifies cargo as a security clearanced one.

- Terminal handling charges (the case of CPT, CIP, CFR, CIF, DAT, DAP, or DDP) – While the freight is paid by the seller, it is actually paid for by the buyer as freight costs are normally included by the seller in the total selling price. The carriage costs will sometimes include the costs of handling and moving the goods within port or container terminal facilities and the carrier or terminal operator may well charge these costs to the buyer who receives the goods. The buyer will want to avoid paying for the same service twice: once to the seller as part of the total selling price and once independently to the carrier or the terminal operator. The Incoterms® 2010 rules (articles A6/B6) seek to avoid this happening.

- Deliver and procure – In the sale of commodities, cargo is frequently sold several times during transit “down a string”. So, a seller in the middle of the string does not “ship” the goods because these have already been shipped by the first seller in the string. The said seller performs its obligations towards its buyer not by shipping the goods, but by “procuring” goods that have been shipped. For clarification purposes, Incoterms® 2010 rules include the obligation to “procure goods shipped” as an alternative to the obligation to ship goods in the relevant Incoterms rules.

- For the “sea rules” of Incoterms (such as, FOB, CFR, and CIF), all mention of the ship’s rail as the point of delivery has been omitted in preference to the goods being delivered when they are “on board” the vessel. This more closely reflects modern commercial reality and avoids the rather dated image of risk swinging to and from across an imaginary perpendicular line (ship?s rail).

Incoterms® 2010 Classified

The number of terms in is decreased from 13 (as in Incoterms 2000) to 11 due to integrating DAF (Delivered at land Frontier), DES (Delivered Ex Ship), and DDU (Delivered Duty Unpaid) as DAP (Delivered At Place).

| Table 1: Rules of Incoterms® 2010 Classified by Modes of Transport and Kind of Delivery Contract | ||||

| Group E – Departure | Group F – Main Carriage Non Paid | Group C – Main Carriage Paid | Group D – Arrival | |

| Rules for Any Modes of Transport | EXW | FCA | CPT, CIP | DAT, DAP, DDP |

| Rules for Sea and Inland Waterway Transport | FAS, FOB | CFR, CIF | ||

Table 2: Main Seller’s and Buyer’s Respesobilities/Risks by INCOTERMS 2010 Groups |

|

| Seller | Buyer |

Group F (FCA , FAS, FOB) is considered to be “Shipment Contracts” and “Buyer Friendly” |

|

|

|

Group C (CPT ,CIP, CFR, CIF) is considered to be “Shipment Contracts” and “Seller Friendly” |

|

|

|

Group D (DAT ,DAP, DDP) is considered to be “Arrival Contracts” |

|

|

|